Unconstrained Innovation

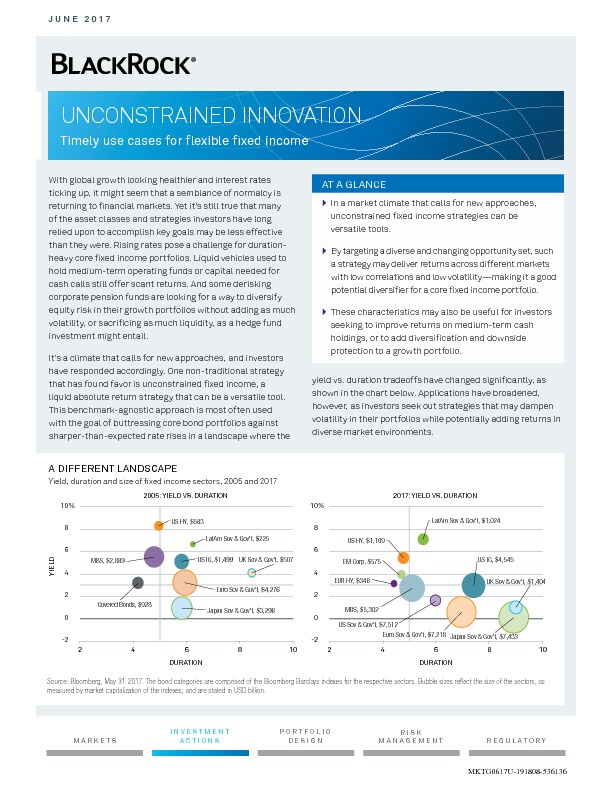

With global growth looking healthier and interest rates ticking up, it might seem that a semblance of normalcy is returning to financial markets. Yet it’s still true that many of the asset classes and strategies investors have long relied upon to accomplish key goals may be less effective than they were.

Rising rates pose a challenge for durationheavy core fixed income portfolios. Liquid vehicles used to hold medium-term operating funds or capital needed for cash calls still offer scant returns. And some derisking corporate pension funds are looking for a way to diversify equity risk in their growth portfolios without adding as much volatility, or sacrificing as much liquidity, as a hedge fund investment might entail.

Om dit artikel te lezen heeft u een abonnement op Investment Officer nodig. Heeft u nog geen abonnement, klik op "Abonneren" voor de verschillende abonnementsregelingen.